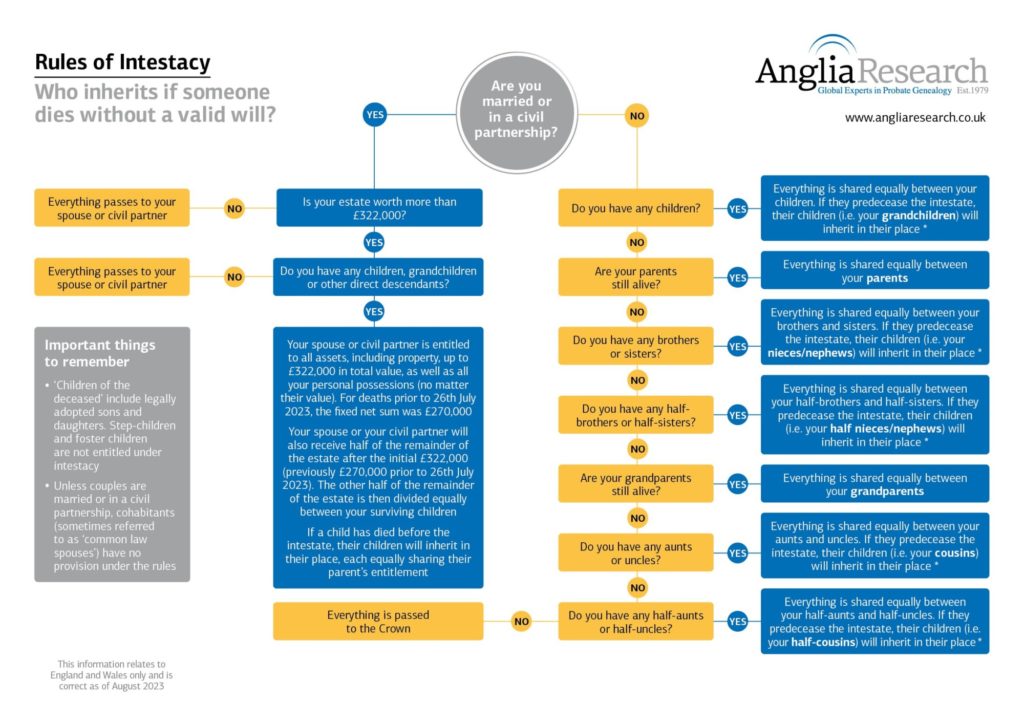

The Laws of Intestacy

The headings below set out the rules for intestate succession in England and Wales. Please note that:

- a husband, wife or civil partner must have survived the deceased by 28 days if they are to be classified as a beneficiary;

- under the rules of intestacy, a partner who wasn’t married or in a civil partnership with the deceased at the time of death has no automatic right to inherit;

- legally adopted sons and daughters are classified as the deceased’s children; however, stepchildren cannot inherit under the intestacy rules;

- a half-blood sibling is a brother or sister who shares one parent with the deceased;

- a half-blood aunt or uncle is the child of one of the deceased’s grandparents.

For a clear explanation of how the rules of intestate succession apply in a particular case, please look through the scenarios below and click the first one that matches the family situation of the case in question.

- The deceased is survived by children, but not by a spouse or civil partner

- The deceased is survived by children and a spouse or civil partner

- The deceased is survived by a spouse or civil partner, but not by children

- The deceased is survived by a parent

- The deceased is survived by siblings or their descendants

- The deceased is survived by half-blood siblings or their descendants

- The deceased is survived by grandparents

- The deceased is survived by uncles and aunts or their descendants

- The deceased is survived by uncles and aunts of the half blood or their descendants

- None of the relatives mentioned above survive the deceased

You may also like to view below our Intestacy rules flowchart to help you understand (applicable to England and Wales only).

The deceased is survived by children, but not by a spouse or civil partner

In England and Wales, when someone dies intestate with no surviving spouse or civil partner, but with surviving children or other descendants, the whole estate passes to the children in equal shares. In cases where a son or daughter has died, their share of the inheritance will be divided among their children.

The deceased is survived by children and a spouse or civil partner

The Inheritance and Trustees’ Power Act, which came into effect on 1 October 2014, made a number of changes to the intestacy rules. Broadly, these ensure that estate distribution is more favourable to the deceased’s surviving spouse or civil partner.

For deaths that took place on or after 26 July 2023

In England and Wales, when someone dies intestate, leaving a spouse or civil partner and surviving children or other descendants:

- the spouse or civil partner inherits the personal effects or chattels of the deceased, the first £322,000 of the estate and half of the remaining estate. This means that in cases where the estate is less than £322,000 the spouse or civil partner will inherit the whole of the estate;

- the children inherit the other half of the remaining estate. In cases where a son or daughter has died, their share of the inheritance will be divided among their children.

For deaths that took place on or after 6 February 2020 but before 26 July 2023

In England and Wales, when someone dies intestate, leaving a spouse or civil partner and surviving children or other descendants:

- the spouse or civil partner inherits the personal effects or chattels of the deceased, the first £270,000 of the estate and half of the remaining estate. This means that in cases where the estate is less than £270,000 the spouse or civil partner will inherit the whole of the estate;

- the children inherit the other half of the remaining estate. In cases where a son or daughter has died, their share of the inheritance will be divided among their children.

For deaths that took place on or after 1 October 2014 but before 6 February 2020

In England and Wales, when someone dies intestate, leaving a spouse or civil partner and surviving children or other descendants:

- the spouse or civil partner inherits the personal effects or chattels of the deceased, the first £250,000 of the estate and half of the remaining estate. This means that in cases where the estate is less than £250,000 the spouse or civil partner will inherit the whole of the estate;

- the children inherit the other half of the remaining estate. In cases where a son or daughter has died, their share of the inheritance will be divided among their children.

For deaths that took place before 1 October 2014

In England and Wales, when someone has died intestate, leaving a spouse or civil partner and surviving children or other descendants:

- the spouse or civil partner inherits the personal effects or chattels of the deceased, the first £250,000 of the estate (£125,000 if the death was before 1 February 2009) and a life interest in half of the remaining estate. This means that in cases where the estate is less than £250,000 (£125,000 if the death was before 1 February 2009), the spouse or civil partner will inherit the whole of the estate;

- the children inherit the other half of the remaining estate. In cases where a son or daughter has died, their share of the inheritance will be divided among their children. Note that children or their surviving issue also receive the half of the remaining estate in which the spouse had a life interest upon the death of the spouse.

The deceased is survived by a spouse or civil partner, but not by children

For deaths that took place on or after 1 October 2014

In England and Wales, when someone dies intestate, leaving a spouse or civil partner, but no surviving children or other descendants, the spouse or civil partner will inherit the whole of the estate.

For deaths that took place before 1 October 2014

In England and Wales, when someone has died intestate, leaving a spouse or civil partner, but no surviving children or other descendants, it is important to investigate whether the deceased is survived by parents, brothers and sisters, or nieces and nephews.

When there are no surviving parents, brothers and sisters, or nieces and nephews, the deceased’s spouse or civil partner will inherit the whole estate.

When there are surviving parents, brothers and sisters or nieces and nephews:

- the deceased’s spouse or civil partner will inherit the personal effects or chattels of the deceased, the first £250,000 of the estate (£125,000 if the death was before 1 February 2009), and half of the remaining estate absolutely;

- the surviving relatives will inherit the other half of the remaining estate, in the following order of priority:

- parents (where one or both parents survive, they will inherit half of the remaining estate absolutely);

- siblings (where both parents have died, the deceased’s brothers and sisters share half of the remaining estate). In cases where a brother or sister has died, their share of the inheritance will be divided among their children, the deceased’s nieces and nephews.

The deceased is survived by a parent

In England and Wales, when someone dies intestate, leaving no spouse, surviving children or other descendants, their whole estate is shared equally between the surviving parents.

The deceased is survived by siblings or their descendants

The intestacy rules for England and Wales state that when there is no surviving spouse, children, other descendants or parents, the estate will pass in its entirety to the deceased’s full-blood brothers and sisters. In cases where a brother or sister has died, their share of the inheritance will be divided among their children.

The deceased is survived by half-blood siblings or their descendants

The rules of intestacy for England and Wales stipulate that an estate must pass in its entirety to the deceased’s half-blood siblings or their descendants when there is no surviving:

- spouse or civil partner

- children or other descendants

- parents

- full-blood brothers and sisters or their descendants.

In cases where a half-blood brother or sister has died, their share of the inheritance will be divided among their children.

The deceased is survived by grandparents

The intestacy rules for England and Wales stipulate that an estate must pass in its entirety to the deceased’s grandparents, when there is no surviving:

- spouse or civil partner

- children or other descendants

- parents

- full-blood brothers and sisters or their descendants

- half-blood brothers and sisters or their descendants.

The deceased is survived by uncles and aunts or their descendants

The intestacy rules for England and Wales stipulate that an estate must pass in its entirety to the deceased’s full-blood uncles and aunts or their descendants when there is no surviving:

- spouse or civil partner

- children or other descendants

- parents

- full-blood brothers and sisters or their descendants

- half-blood brothers and sisters or their descendants

- grandparents.

In cases where an aunt or uncle has died, their share of the inheritance will be divided among their children.

The deceased is survived by uncles and aunts of the half blood or their descendants

The rules for intestate succession in England and Wales stipulate that an estate must pass in its entirety to the deceased’s uncles and aunts of the half blood or their descendants when there is no surviving:

- spouse or civil partner

- children or other descendants

- parents

- full-blood brothers and sisters or their descendants

- half-blood siblings or their descendants

- grandparents

- full-blood uncles and aunts or their descendants.

In cases where a half-blood aunt or uncle has died, their share of the inheritance will be divided among their children.

None of the relatives mentioned above survive the deceased

In England and Wales, the estate is classed as ownerless property (‘Bona Vacantia’) and passes to the Crown or, in Cornwall and Lancashire, to the relevant Duchy.

Frequently Asked Questions

To find out more about us, click on the questions below. Please don’t hesitate to contact us directly if there is anything else you would like to know.

Why have you contacted me?

We contact people when, as a result of our research, we believe that they may be entitled to inherit from the estate of a deceased relative who died without leaving a will.

Alternatively, we may get in touch to enquire about a family member, neighbour or friend whom we want to trace – again, because they may be entitled to inherit from an estate.

We also act for solicitors and executors who are trying to find missing heirs who have been named in a will, and for insurance companies and banks seeking the owners of dormant accounts.

What is probate genealogy? How does it work?

If somebody with no known relatives dies without leaving a will, their assets will eventually pass to the Crown. The authorities make very little attempt to trace relatives, other than to place advertisements with minimal information in the media. Therefore, there is every likelihood that rightful beneficiaries would never know about their entitlement, but for the involvement of a probate genealogist.

Probate genealogists seek out the relevant advertisements and, acting on their own initiative, try to identify and locate the relatives who are entitled to inherit from the intestacy.

How do I know that this is a genuine matter? What are your credentials?

At Anglia Research we understand that the people we contact might be concerned and apprehensive. They needn’t be.

- We are registered with, and therefore regulated by, the Financial Conduct Authority (FCA).

- Most of our case managers hold paralegal practising certificates and are regulated by CILEX, reassuring you of an independent complaints procedure and compensation scheme.

- Our founder and many of our researchers are members of the Association of Genealogists and Researchers in Archives or its Scottish and Irish equivalents, the Association of Scottish Genealogists and Researchers in Archives and Accredited Genealogists Ireland.

- Our company registration is 5405509 and can be found at Companies House.

To find out more, please see our accreditation page.

No-one in my family ever had a penny to their name. Is there an error somewhere?

We often hear this! However, we might be talking about quite a distant relationship, such as a half-blood cousin four times removed. Hardly anyone knows all their relatives to that extent.

How did you trace me? Are my details safe?

We use information in the public domain and available to anyone. This includes birth, marriage and death indexes, census data and electoral roll records. We also have our own considerable library of genealogical resources, accumulated during the company’s five decades of operation.

You can rest assured that your details will never be passed onto a third party without your permission and that they will only ever be used in the context of the research we are conducting.

Might I be contacted by more than one company?

This sometimes happens in cases of intestacy. The probate genealogy industry is highly competitive and when someone with no known relatives dies without leaving a will, several different companies may try to trace the heirs to the estate.

It is important to remember that in these cases, no particular company is appointed to ensure that the unclaimed estate reaches its rightful owners. Each probate research company acts on its own initiative.

In that case, do all of the potential heirs have to sign up with the same company?

No. Should a number of heirs (or beneficiaries) sign with different companies it has no effect upon their entitlement other than the fee involved. However, it will always be in your best interest to sign an agreement with Anglia Research.

See here for six reasons why.

How do I know that the fee stated in your agreement is the only fee I will pay? Are there any hidden costs?

The fees set out in the agreement are the only fees Anglia Research will ever ask you to pay. There are no hidden costs and Anglia Research will never ask you to pay any money from your own pocket. This is our guarantee to you.

How is your fee decided?

We take into account the value of the assets (if known), the complexity of the case, the number of relatives and many other aspects. We avoid London rents and salaries so that our overheads can be kept low, thus ensuring that you receive a high share of your entitlement.

You haven’t told me the name of the deceased. Why?

At our own expense, we have invested time, effort and money to establish your connection to the deceased person and the unclaimed assets. We propose to pass on this information to you in return for a fee agreement. We would love to give you the information first, but we need to secure our fee by having a signed agreement in place before we can disclose details.

Can I visit your offices to discuss the matter?

Of course. Please contact your case manager or call Head Office to arrange a visit.

I have signed your agreement, what happens next?

Once we have agreements back from entitled relatives, we submit a claim to the Treasury on behalf of one representative family member. When the claim has been admitted, it is usual for the same relative to become the personal representative (PR). A solicitor is then chosen to work with the PR and deal with the administration of the estate. They undertake the work of gathering in the estate’s assets and paying out its liabilities. Only when this is done can the solicitor calculate how much each beneficiary is due and then make a distribution.

What about the solicitor’s costs?

They are paid out of the estate’s assets before it is distributed.

Are all solicitors' costs and services equal?

Far from it. Some probate research firms direct their clients to expensive solicitors. To help justify high costs, they produce complicated accounts and create unnecessarily complex family trees – all meant to impress. Others, especially newcomers, will use inexperienced solicitors who end up floundering if the case takes an unexpected turn.

At Anglia Research, we ensure that paperwork is easily understood. For estate administration, we can refer you to a panel of good-value experienced solicitors. We also offer our own low-cost, in-house administration service, led by a solicitor with a background in a major law firm.

How long is the process likely to take?

It is impossible to give a detailed timeline of how long the process will take, as every case is different. Although most cases are managed within six to nine months, there are always exceptions to the rule.

How much am I entitled to?

In many cases, we are unaware of the full value of the estate we are researching. As a result, it is not always possible to estimate individual entitlements until our research is complete, all the entitled relatives have been located and the claim has been accepted by the Treasury.

What if I am not entitled after all, or the claim is not successful? Will I still have to pay you?

Absolutely not. Our fee is conditional upon you receiving something from the estate. There is no catch – you will never be asked to pay more than an agreed percentage of your inheritance, so if the claim is unsuccessful and you receive nothing, you will pay us nothing.

Is it possible for your fees to exceed what I receive from the estate?

As our fee is based upon a percentage or proportion of what you are due from the estate, it will always be less than the sum you inherit. To repeat – there is no catch.

How do you get paid?

Our fee is paid by the administrator of the estate when the assets are distributed, so we do not get paid until you receive your inheritance.

What happens to the personal possessions of the deceased?

Sadly, in the vast majority of cases, the personal possessions of the deceased will have been disposed of, or sold to add to the monetary value of the estate. However, in a minority of cases, we are given items, such as old photographs or address books, that can be passed on to the wider family.

I'm very interested in my family history. Can I get a copy of your research?

Certainly. Should you require a copy of the family tree, please speak to your case manager.

I'd like to make contact with long lost/unknown relatives. Can you give me their details?

Anglia Research complies the EU General Data Protection Regulation (GDPR). This means that we can’t and won’t pass anybody’s details to a third party without their consent. However, we can ask for permission to pass on details on your behalf. We also offer a free letter-forwarding service for this purpose.

2025 Anglia Research Services All Rights Reserved.

Anglia Research and Anglia Research Services are trading names of Anglia Research Services Limited, a company registered in England and Wales: no. 05405509

Marketing by Unity Online