What Are the Probate Threshold Limits in England and Wales in 2025?

When someone passes away, their assets – such as bank accounts, savings, and investments – may require a grant of probate or letters of administration before they can be accessed by or paid out to executors or administrators, respectively.

When there is a valid will, probate is the legal process that confirms an executor’s authority to deal with a deceased person’s estate. If there is no valid will, Letters of Administration are obtained when the intestacy rules are applied in the absence of a will. Financial institutions will require sight of either of these.

(There may be other reasons to obtain probate or letters of administration even if a financial institution does not require them, but that is beyond the scope of this article, and always take advice from a trusted professional).

Financial institutions set their own probate thresholds, meaning that if the total funds held with them fall below a certain limit, they may release the money without requiring a Grant of Probate or Letters of Administration.

Throughout this article and in the table below, we will use the term probate threshold as a general term to apply to thresholds where there is and is not a will, unless otherwise specified.

How Do Probate Thresholds Work?

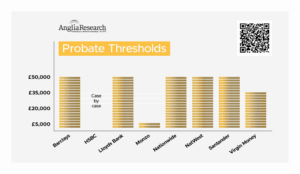

Each bank and building society in England and Wales determines its own probate threshold. There is no ‘one size fits all’ across the financial industry. These limits vary widely between financial institutions, typically ranging from £5,000 to £50,000 or more.

In some cases, financial institutions apply different limits based on specific conditions, such as:

- Whether the deceased had a will or not.

- Whether the executor is a professional (e.g., a solicitor).

- The type of account or investment held.

For example, some institutions set a lower threshold for intestacy cases, with one particular bank insisting on Letters of Administration before they will release any funds. Others may allow significantly higher limits if a professional executor is managing the estate.

What Does This Mean for Executors and Beneficiaries?

If an estate falls below the relevant probate threshold, funds may be released more quickly and with less administrative burden. Typically, the bank will still request:

- A death certificate.

- Proof of identity for the person making the claim.

- A completed indemnity form or small estates declaration.

- Sight of a certified copy of a will or a family tree.

Since each financial institution has its own policies, it is essential in every case for executors or administrators to check directly with them to confirm their requirements.

The table below provides a summary of the current probate thresholds set by various financial institutions as of May 2025. Details correct at the time of publishing:

Institution |

Probate Threshold |

Conditions and Caveats |

| Atom Bank | £5,000 | |

| Bank of Ireland | £30,000 | In the Republic of Ireland, if the estate value exceeds £20,000. |

| Bank of Scotland | Case-by-Case | The bank will usually only need to see the Grant of Probate or equivalent document if the value of the account(s) is more than £50,000. |

| Barclays | £50,000 | |

| Birmingham Midshires | £50,000 | £175,000 if a professional executor has been instructed. |

| Chase Bank | £25,000 | |

| Coventry Building Society | £50,000 | |

| First Direct | £20,000 | Might be considered on a case-by-case basis. |

| Halifax | Case-by-Case | The bank will usually only need to see the Grant of Probate or equivalent document if the value of the account(s) is more than £50,000. |

| Handlesbanken | £20,000 | |

| HSBC | Case-by-Case | |

| Leeds Building Society | £50,000 | |

| Lloyds Bank | Case-by-Case | The bank will usually only need to see the Grant of Probate or equivalent document if the value of the account(s) is more than £50,000. |

| M&S Bank | £5,000 | |

| Metro Bank | £25,000 | |

| Monzo | £5,000 | |

| Nationwide | £50,000 | |

| NatWest | £50,000 | |

| NS&I | Case-by-Case | |

| Post Office Savings | £30,000 | A Grant of Letters of Administration required if the deceased had no will. |

| Revolut | £5,000 | |

| Royal Bank of Scotland | Case-by-Case | |

| Sainsbury’s Bank | £25,000 | |

| Santander | £50,000 | |

| Skipton Building Society | £30,000 | |

| Starling Bank | £10,000 | |

| Tandem Bank | Case-by-Case | |

| Tesco Bank | £50,000 | |

| The Co-Operative Bank | £50,000 | |

| TSB Bank | Case-by-Case | |

| Virgin Money | £35,000 | |

| Yorkshire Bank | £35,000 | |

| Yorkshire Building Society | £30,000 |

Please note that thresholds can change at any time, and institutions may not be consistent in their application of thresholds.

2026 Anglia Research Services All Rights Reserved.

Anglia Research and Anglia Research Services are trading names of Anglia Research Services Limited, a company registered in England and Wales: no. 05405509

Marketing by Unity Online